The purpose of depreciation is to match the timing of the purchase of a fixed asset (“cash outflow”) to the economic benefits received (“cash inflow”). The concept of depreciation describes the allocation of the purchase of a fixed asset, or capital expenditure, over its useful life. In accrual accounting, the “Accumulated Depreciation” on a fixed asset refers to the sum of all depreciation expenses since the date of original purchase. You can learn more about the concept of depreciation in this Wikipedia article in greater detail.How to Calculate Accumulated Depreciation? Using this calculator, you can get an accurate assessment of your car's residual value at any chosen moment in time and make informed decisions about selling, buying, or using a car. This will allow you to visually compare the calculation results and choose the method that best suits your needs. The chart will show the change in the car's residual value over months for each of the three depreciation methods. Each row in the table will indicate the month and corresponding residual value of the car for each method. The table will contain columns for each of the three depreciation methods: straight line, accelerated, and market value. Optionally: Enter the residual value of the car that you want to consider in the calculations in the " Residual Value" field.Īfter entering the data into the calculator and clicking the " Calculate Depreciation" button, the calculator will generate a table and a chart displaying the residual value of the car depending on the selected depreciation calculation method.Enter the date you want to calculate the depreciation for in the " Current Date" field.Enter the current market value of the car in the " Current Market Value" field, if available.Enter the car's depreciation term in years in the " Depreciation Term Years" field.Enter the initial cost of the car in the " Purchase Cost" field.

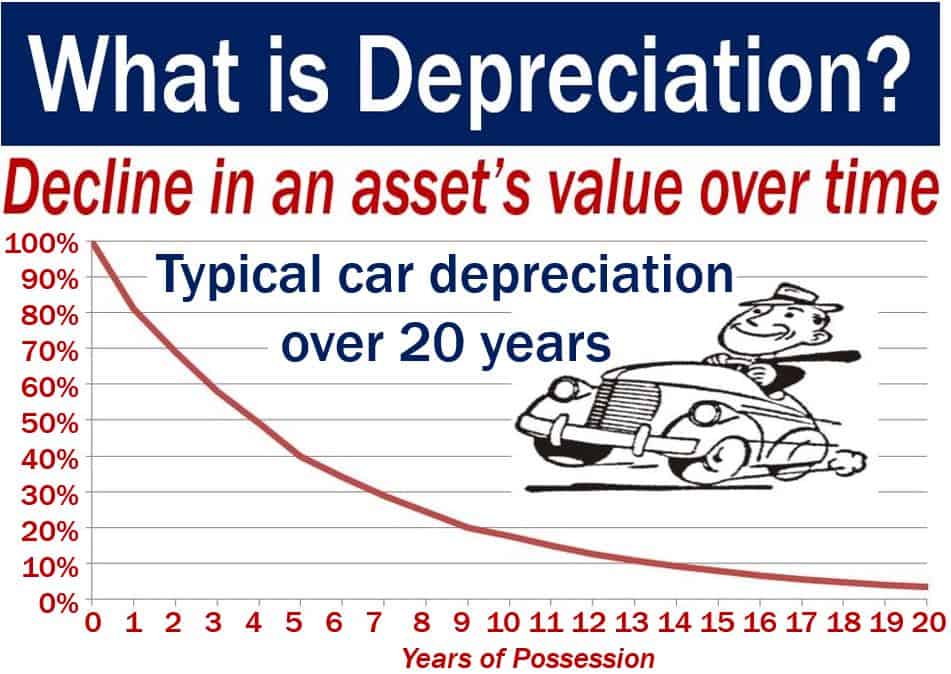

Enter the car's purchase date in the " Purchase Date" field.The depreciation amount is calculated based on the difference between the initial cost of the car and its market value, divided by the number of months since the purchase. Market Value Method: This method takes into account the car's current market value. The depreciation amount each month will decrease, and the car's value will approach the specified residual value. The depreciation amount each month will be the same, and the car's value will gradually decrease to a specified residual value.Īccelerated Method: In this method, depreciation occurs faster at the beginning of the car's service life and slows down over time. Straight Line Method: This method is based on the even distribution of the car's cost throughout its service life. This app uses the most precise methods - the Market Value and Straight Line approaches - to deliver accurate tracking of your car's ownership costs.ĭescription of depreciation calculation methods: If you wish to consistently monitor the Total Cost of Ownership (TCO) for your car, consider installing our ARBA Auto app. The calculator will help you determine the best depreciation method and track how the value of your car changes over time. You simply need to specify the date and cost of purchase, as well as the period during which you plan to use your car. This is a useful tool for determining the best time to sell or replace a car, as well as for accounting for taxes and other economic aspects of owning a car.īelow is a depreciation calculator that will help you calculate the change in the residual value of your car, taking depreciation into account. Calculating depreciation allows you to determine how the value of your car will change from the moment of purchase. Depreciation of a car is the process of accounting for its decrease in value over time due to wear and tear and obsolescence.

0 kommentar(er)

0 kommentar(er)